Title: “Crypto Market Revival: Spotting Reversal Patterns and Bullish Trading Signals”

Introduction

The world of cryptocurrencies has been known for high price volatility in recent years. With the emergence of new technologies and the growing acceptance of digital currencies, the market has become increasingly unpredictable. One of the strategies that traders have used to manage this unpredictability is to recognize reversal patterns and trading signals. In this article, we will explore the concept of a reversal pattern and how it can be used as a bullish trading signal in the crypto market.

What is price volatility?

Price volatility refers to the price fluctuations of cryptocurrencies over time. These fluctuations are caused by various factors such as changes in investor sentiment, news events, regulatory updates and technical analysis. High price volatility can lead to significant price swings, challenging traders to reliably predict market movements.

Reverse Patterns

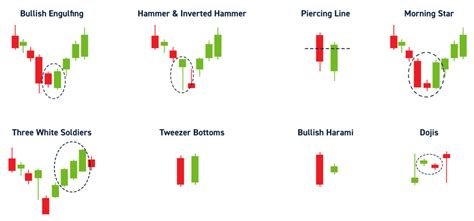

A reversal pattern is a specific sequence of price movements that indicates a potential change in the market trend. Reversal patterns are crucial in trading because they provide valuable insights into the direction of the market and can help traders make informed decisions. Some common reversal patterns include:

- Head-and-Shoulders: A classic reversal pattern characterized by a high price level followed by a decline, often followed by lower highs.

- Trend Reversal: A simple reversal pattern where a trend changes direction, usually after an extended uptrend or downtrend.

- Mean Reversion

: A more complex reversal pattern that involves a return to mean levels, which are determined by historical price data.

Trading signal: “recovery candle”

The concept of trading signals is based on identifying a specific candlestick pattern within the cryptocurrency market. A “recovery candle” is one such pattern that indicates a potential market recovery after a prolonged downtrend or uptrend. Here’s how to recognize this pattern:

- Candlestick Analysis: Use technical analysis tools to analyze the price chart of a particular cryptocurrency. Look for candlesticks that form during periods of significant price volatility.

- Recovery Candlestick Pattern

: Identify a candlestick that opens below the previous low and closes above the previous high. This is known as a “recovery candlestick”.

- Confirmation : A recovery candle must be followed by a continuation of the uptrend or downtrend, indicating that the pattern is indeed a reversal of the original trend.

Using the Recovery Candle Pattern in Crypto Trading

A recovery candle pattern can be used as a bullish trading signal to initiate a trade cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and others. When this pattern is identified, it means that the market is about to recover, which can lead to significant price movements.

For example:

- Buy BTC/ETH : Identify a recovery candle on the Bitcoin (BTC) or Ethereum (ETH) price chart. This indicates that the market is ready to recover after a prolonged downtrend.

- Take Profit: Close your position immediately after the recovery candlestick when the cryptocurrency reaches the target price level.

Conclusion

The Crypto Market Revival: Identifying a Reversal Pattern and Bullish Trading Signal offers valuable insights into the high-pressure environment of the crypto market . By recognizing the recovery candle pattern, traders can gain an edge in making informed decisions about their trades. As the crypto market continues to evolve, this strategy will remain a key tool for traders looking to navigate its unpredictable landscape.

Disclaimer: This article is for informational purposes only and should not be considered investment advice.