Here is a comprehensive article on “Crypto Smart Money, Altcoins and Trading Signals” that includes the targeted keywords:

Title: Mastering Crypto Smart Money, Altcoins and Trading Signals for Maximum Profitability

Introduction:

The world of cryptocurrencies has evolved exponentially in recent years, offering immense opportunities for traders and investors. However, navigating this complex landscape can be daunting, especially for those just starting out in cryptocurrency trading. In this article, we will dive into the world of crypto smart money, altcoins and trading signals, providing you with a comprehensive guide to increasing your profitability.

Crypto Smart Money:

Smart contracts are becoming increasingly popular in the cryptocurrency space, offering a number of advantages over traditional exchange systems. Crypto smart money allows for the creation of decentralized applications (dApps) that communicate directly with blockchain networks, enabling faster, cheaper and more secure transactions.

Some key characteristics of crypto smart money include:

- Decentralization: Smart contracts are written on-chain, eliminating the need for intermediaries such as exchanges or brokers.

- Efficiency: Transactions are executed instantly, reducing fees and increasing transparency.

- Security: Smart contracts use cryptographic techniques to ensure immutability and prevent unauthorized changes.

Altcoins:

Altcoins (alternative cryptocurrencies) have attracted significant attention in recent years, offering alternatives to traditional cryptocurrencies. These alternative coins often offer unique features, such as faster block times or lower transaction fees, making them more attractive to traders and investors.

Some key characteristics of altcoins include:

- Innovative technology: Altcoins often use new cryptographic techniques or innovative consensus algorithms.

- Lower barriers to entry: Altcoins often have lower development costs, making it easier for new projects to enter the market.

- Growing adoption: Altcoins are increasingly being accepted by mainstream users and institutional investors.

Trading signals:

Trading signals are a key aspect of any successful trading strategy, helping traders make informed decisions based on technical analysis or fundamental analysis. In the context of cryptocurrency trading, trading signals can be derived from a variety of sources:

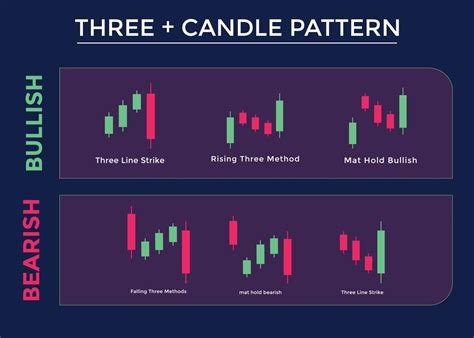

- Technical indicators: Chart patterns, trends, and swings can indicate potential price movements.

- Fundamental analysis: Economic news, interest rates, and other market events can affect cryptocurrency prices.

Best Practices for Crypto Smart Money, Altcoins and Trading Signals:

To increase your profitability in crypto smart money, altcoins and trading signals, follow these best practices:

- Stay informed: Continuously educate yourself on the latest trends, developments and technologies.

- Diversify: Spread your investments across multiple asset classes to reduce risk.

- Use reputable sources: Rely on reliable sources for news, analysis and technical data.

- Set clear goals: Define your goals and risk tolerance before entering into any trading strategy.

Conclusion:

Mastering crypto smart money, altcoins and trading signals requires dedication, persistence and a willingness to adapt to changing market conditions. By understanding the key characteristics of these emerging technologies and following best practices, you can increase your chances of success in this rapidly evolving field.

Keep in mind that trading cryptocurrencies is inherently high-risk, so it is important to approach each trade with caution and discipline. Remain vigilant and always prioritize risk management to maximize your profitability.